Project Description

AS/A Level Accounting Course

Exam board: AQA

AS Level: 7126 – A level: 7127

Accounting is known as the language of business. It is essential for the recording and presentation of business activities in the form of business accounts, financial reporting in the form of financial statements and the provision of relevant economic information for management decision making and control. Accounting serves this purpose by identifying, classifying and summarising, and presenting financial information in order to facilitate decision making and compliance with the law. It looks at ways in which businesses can maximise profits, manage costs and allocate resources effectively and efficiently.

Which subjects combine well with Accounting?

Accounting combines well with Mathematics and Business Studies. It may also complement Sociology and Law.

What careers and University courses can Accounting lead to?

Studying Accounting will provide a student with one of the most sought after skills in any business. An understanding of the financial health is of utmost importance to any business and all businesses employ the services of accountants to look after their financial affairs. Accounting knowledge can be very useful for you if you decide to be an entrepreneur in future, become a thriving finance professional or just lend a hand in the running of your family business.

A level Accounting is relevant for students who want to pursue a degree in Accounting or Business Studies at university. Almost all such degrees may have several Accounting modules in their programmes.

Entry Requirements

To study AS/A Level Accounting you need a minimum of five GCSEs at grade 4-9 / C or above including English Language and Mathematics

Curriculum

Building on the firm foundation for AS the unit at A Level will present more in-depth of financial accounting and extensive coverage of management accounting.

The specification emphasises both financial accounting and the recording of past events, and management accounting as a means of planning and decision making based on this specification should encourage students to:

- understand the role and develop the skills of the accountant in developing and evaluating accounting information systems and in preparing financial and management accounting information

- apply the principles and techniques of accounting in the preparation of financial and management accounting information including using the double entry model to: record transactions; prepare financial statements for different types of organisations; and prepare management accounting information to enable management to plan, control and make decisions

- analyse and evaluate a range of financial and management information and communicate the outcomes numerically and verbally

- evaluate the impact of ethical considerations on the accountant and the duty to be truthful and accurately represent the facts when preparing and presenting accounting information, undertaking financial decision making and addressing the concerns of stakeholders

- develop the ability to solve problems logically, analyse data methodically, make reasoned and justified decisions and use different reporting methods to communicate these to stakeholders.

Subject content

The Accountacy AS level course comprises 10 modules.

The following modules need to be studied by all students.

- An introduction to the role of the accountant in business

- Types of business organisation

- The double entry model.

- Verification of accounting records

- Accounting concepts used in the preparation of account records

- Preparation of financial statements of sole traders

- Limited company accounts

- Analysis and evaluation of financial information

- Budgeting

- Marginal costing

The Accountacy A level course comprises 18 modules.

The following modules need to be studied by all students.

- An introduction to the role of the accountant in business

- Types of business organisation

- The double entry model

- Verification of accounting records

- Accounting concepts used in the preparation of accounting records

- Preparation of financial statements of sole traders

- Limited company accounts

- Analysis and evaluation of financial information

- Budgeting

- Marginal costing

- Standard costing and variance analysis

- Absorption and activity based costing

- Capital investment appraisal

- Accounting for organisations with incomplete records

- Partnership accounts.

- Accounting for limited companies

- Interpretation, analysis and communication of accounting information

- The impact of ethical considerations

Assessments

This qualification is linear. Linear means that students will sit all their exams at the end of the course

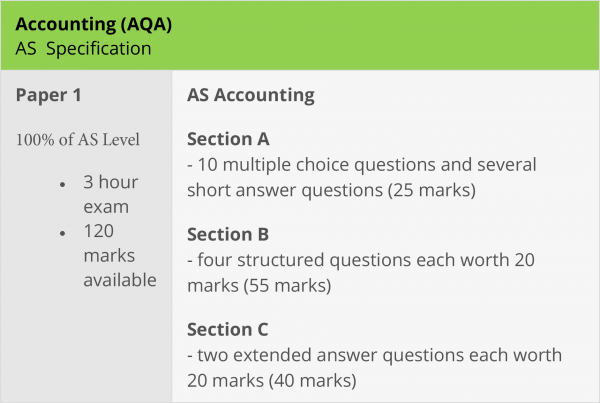

AS Level

AS Level consist of one exam paper which assesses Sections 1–10 of the subject content.

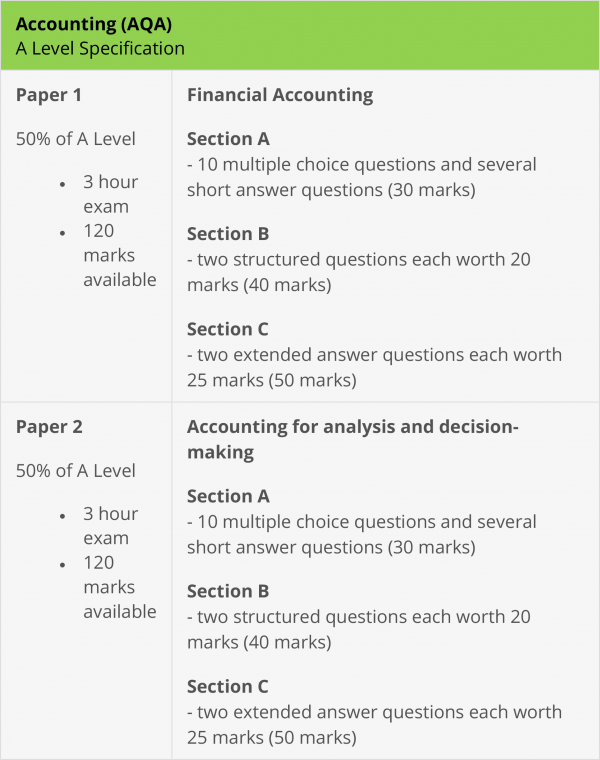

A Level

A Level consist of two exam papers which assesses sections 1–8, 14–18 of the subject content.

Access Arrangements

Access Arrangements allow candidates/learners with special educational needs, disabilities or temporary injuries to access the assessment without changing the demands of the assessment.

For example, readers, scribes and Braille question papers. In this way, Awarding Bodies will comply with the duty of the Equality Act 2010 to make ‘reasonable adjustments’.

We can arrange access arrangements and assess you with our special assessor. The deadline for application to the exam board is the February of the year the learner sits the exams.

To find out more about exam access arrangements click here.

FAQs

SWANSEA COLLEGE A LEVEL COURSES

Have a question? Ask our virtual assistant on live chat below

or call us on 01792 535000 and speak to our experienced Student Adviser.